Knight Frank Residential Agency: House Prices In Dubai To Climb 8% In 2025

House prices across Dubai currently stand 19.9% higher than they were at this time last year and with no let-up in demand, residential values are expected to climb by a further 8% during 2025, according to global property consultancy, Knight Frank’s Middle East Residential Agency team, which is detailed in Knight Frank’s Dubai Residential Market Review: Special Edition.

Dubai’s residential market continues to experience exceptional demand, as evidenced by the surge in property transactions throughout 2024. In Q3 2024, the number of transactions reached a record-breaking 47,269, the highest quarterly figure on record. This marks a 41.8% increase compared to the same period in 2023.

In the first three quarters of 2024 alone, 121,978 home sales were registered, surpassing the total number of transactions recorded for the entirety of 2023.

The total value of deals between January and September 2024 exceeded AED 306.3bn — a 36% increase over the same period in 2023. In Q3 alone, the sales volume reached AED 116.8bn, an historic high.

Faisal Durrani, Partner – Head of Research, MENA, explained: “House prices in Dubai continue to be fuelled by relentless demand. Unsurprisingly, prices in the mainstream market continue to edge upwards, climbing by 4.3% in Q3, taking city-wide prices up by 19.9% on this time last year, underpinned in part by the tapering off in the number of homes available for sale. Across the city, there has been a 30% year on year decline in the number of property listings.

Furthermore, the rate at which luxury homes are selling has also continued to climb, tripling over the last 18 months to almost one in every five homes listed being sold between June and September”.

HOUSING SUPPLY

Developers have been racing to satisfy the growing levels of demand for housing and Knight Frank’s estimates now show that close to 300,000 homes are due across Dubai between now and the end of 2029.

Apartments will account for 80.1% of the supply due by 2029, while 17.4% will be villas.

Knight Frank expects the villa shortage to persist, with just 8,900 new villas expected by the end of 2024 and a further 19,700 – by the end of 2025.

Knight Frank has also run three population growth scenarios to understand the potential mismatch between supply and future projected population growth:

Over the course of the next 16 years, through to 2040, Knight Frank forecasts that Dubai will need in the region of 37,600-87,700 homes each year in order to accommodate between 5.8-8.6 million residents. This assumes both low and high population growth rates.

Assuming historical delays of up to 30% of units each year persists, 210,000 units will realistically be completed over the next six years. This translates into 35,000 homes per year for the next six years, hinting at a likely long-term shortfall in housing, notwithstanding the cyclical nature of the market and risks to ongoing price appreciation.

Petri Mannila, Partner – Head of Prime Residential UAE, said: “The limited availability of sites across key locations in the city is also contributing to rising prices for off-plan homes, while stock in the secondary market too is experiencing significant price growth, especially where older homes have been refurbished.

While it may appear that there is likely to be a slight shortfall in the supply needed to house Dubai’s growing population, the lack of development sites and homes for sale, either off-plan, or ready, is going to continue creating a bigger delta between the city’s prime neighborhoods and the rest of Dubai.”

MARKET RISKS

Despite the likely supply-demand imbalance that is expected to underpin house price growth in the long term, Knight Frank has identified three key risks to Dubai’s property market.

Global economic slowdown (high risk): Macroeconomic risks to the real estate sector mainly derive from the knock-on effects from a general economic slowdown, soft-landing, or indeed a recession, any of which could both reduce population growth and undermine confidence in the residential market. This remains the most significant threat to the market.

Oil price volatility (medium risk): Dubai is, more likely, exposed to risks deriving from lower global oil prices. While the UAE has very successfully reduced its fiscal reliance on oil in the past 10 years, a prolonged period of lower oil prices could reduce government spending plans across the Gulf. Dubai could witness lower growth rates as a result, although the UAE’s fiscal breakeven oil price has been a key factor in the apparent delinking between the performance of residential values and oil prices since 2017, Knight Frank says.

An oil price spike linked to the ongoing regional hostilities could trigger a global economic slowdown, while also driving up global inflation. Interest hikes in such a scenario are almost inevitable and this could dampen activity in the real estate market as higher borrowing costs for purchases and indeed development would act as a significant dampener. That being said, with 88.7% of residential sales being driven by cash purchases this year, the market is to an extent shielded from any sudden interest rate hikes.

Regional competition (low risk): Dubai, through its main port, Jebel Ali, continues to be the region’s predominant logistics hub. Likewise, Dubai International Airport has helped to make Dubai the region’s leading travel and tourism hub and has indeed been the busiest international airport for 10-years running and the second busiest globally during 2023.

Shehzad Jamal, partner – Strategy & Consultancy, MEA, added: “While other cities around the GCC are heavily investing in reforming their economies and reinventing their economies, this is not viewed as an immediate threat to Dubai’s position as the region’s primary travel, tourism and trade hub. And indeed, with a population of close to 57 million, the GCC region could easily accommodate a second global gateway city, be it Riyadh, or elsewhere”.

2025 OUTLOOK

To project price trends for Dubai’s mainstream residential market in 2025, our Residential Agency team has closely examined historical market data and combined this with market experience to formulate an inhouse view, including the current position in this cycle of growth, which stands at 4.5 years.

Durrani continued: “After almost 5 full years of growth, we expect that the rate of house price growth will begin to slow in 2025. Furthermore, factoring for potential downside risks to the market, the most significant of which is the threat of a global economic slowdown, our Residential Agency team’s view is that the mainstream residential market will experience an average price increase of 8% in 2025.

For Dubai’s prime residential market, following an increase of 6% the last twelve months, we expect values to end 2024 in line with our original consensus forecast of 5% issued last Autumn. For 2025, our Residential Agency team is forecasting growth to be more modest and closer to 5%, which builds on the 44.4% growth registered during 2022 and the 16.3% increase last year”.

Knight Frank points to the luxury villa market has been a standout performer, particularly in waterfront or prestigious locations like the Palm Jumeirah and Jumeirah Islands, where values are now almost double 2014 levels.

PROPERTY WEALTH

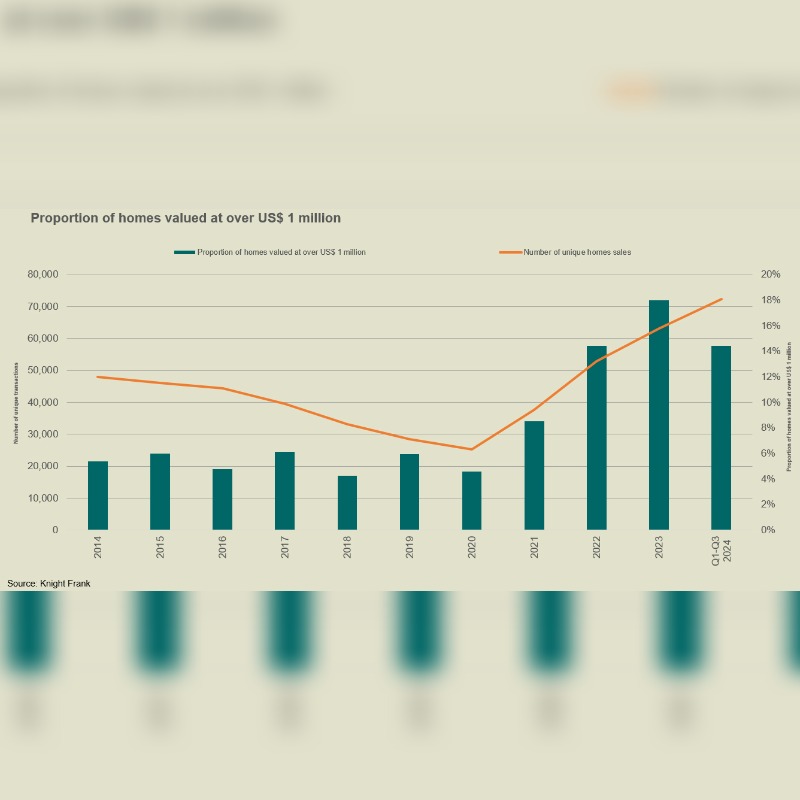

Knight Frank has also carried out analysis around the number of homes in Dubai priced at over US$ 1 million to understand the growing concentration of wealth in the emirate.

By tracking the value of each home’s price progress over time, Knight Frank has been able to identify “accidental millionaires”, i.e., owners who bought properties for less than US$ 1 million that are now worth more purely due to price inflation. Only homes that have not traded hands have been counted.

Durrani said: “Of the 530,000 homes sold since 2002, our analysis shows that 95,000 are worth over US$ 1 million today, which equates to a combined total value of AED 822bn.

What is astonishing however is the rate at which the number of homes valued at over US$ 1 million has grown in Dubai, jumping from just 6.3% of all sales in 2020 to 18.1% today. This effectively means nearly 1 in every five homes in Dubai is worth over US$ 1 million”.

Knight Frank’s analysis also shows that the total value of all homes sold in Dubai since 2002 currently stands at AED 1.47 trillion, which is up 221% since 2020.