Dubai Property Market Holds Firm As Mid-Income Buyers Power Demand

Property Finder, the leading property portal in the MENA region, has released its October 2025 market performance highlights, reporting a moderate slowdown offset by a decrease in primary ready transactions and the off-plan primary segment.

A slight cooling in activity for October 2025 is partly influenced by seasonal factors, such as the summer vacation period, but overall performance across consistently strong segments highlight the resilience of the Dubai property market.

Primary transactions

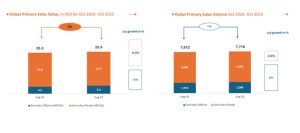

Despite an 8% decline in value and a 6% drop in volume in October compared to October 2024 the primary sales market remained resilient. In the first 10 months of 2025, the segment recorded an 18% year-on-year increase, reaching 103,939 transactions. This strong performance was driven primarily by the surge in primary ready transactions, with primary total value growing by 33% over the same period.

Al Yelayiss 1 emerged as the top-performing area in the primary sales market, with transaction values rising by nearly 7% and volumes climbing sharply from just three to 153 transactions, representing 11% of total primary transaction value. Nad Al Sheba First came in second, accounting for 9% of the total value.

Secondary sales overview

The secondary sales market’s positive performance continued in October 2025, recording AED 25.9 billion across 7,718 transactions, reflecting a slight 2% year-over-year increase in value and a 1% rise in volume.

This growth was boosted by the increase in secondary off-plan sales, which rose by 15% in value and 8% in volume. Key areas that drove the surge include Al Barsha South Fourth, which registered 687 transactions worth AED 1.4 billion compared to AED 768 million in October 2024, and Burj Khalifa, where value grew by 17% year-on year.

Consumer preferences

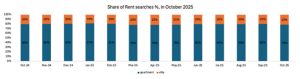

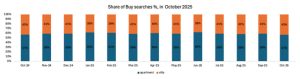

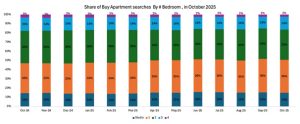

Apartments remain the dominant choice for Dubai’s renters and buyers, continuing a trend that has been reported over the past 12+ months. These popular properties account for approximately 78% of rental searches and 57% of buyer demand. Studio apartments make up around 25% of rental searches, but only 15% of purchase interest.

In contrast, one-bedroom units account for 36% of apartment buy searches versus 37% of rental searches. Interest grew in smaller units, specifically one-bedroom and studio apartments outpacing demand for larger properties, even with studio apartments comprising 15% of purchase interest. This trend likely reflects the impact of rental high prices, prompting tenants to shift toward ownership of affordable smaller units as a way to hedge against rent increases and secure long-term assets.

Dubai’s mortgage market

Dubai’s mortgage market remained steady in October 2025, recording AED 15.98 billion across 3,999 transactions, with Mortgage Finder data showing significant activity among mid-income earners.

Total value slipped by 1% year-on-year, but transaction volumes rose by 10%, reflecting sustained end-user demand supported by mortgage financing rather than cash purchases. This divergence between value and volume highlights a shift toward smaller-deal transactions, as buyers with modest budgets gravitate toward more affordable units. The average mortgage value per unit fell by 16% compared to October 2024, reaching AED 4.17 million, indicating that financing activity remains healthy, but skewed toward mid-income segments.

Year-to-date, Dubai recorded AED 148.1 billion in mortgage transactions from 35,554 deals. While value remains broadly stable, volume is up by 19% versus 2024. This growth, coupled with a 10% drop in the average mortgage value per unit, suggests that affordability and end-user ownership are driving demand. Overall, the mortgage market’s performance signals a maturing phase of sustainable demand, where buyers remain active but increasingly value-conscious, balancing aspirations for homeownership with financial prudence.

Mortgage Finder’s data reveals the AED 20K-40K monthly income group accounts for nearly 30% of all mortgage requests, making it the market’s largest income segment. Within this bracket, 81% of buyers are searching for homes to live in, while 16% are seeking investment opportunities, confirming that mid-income earners are active buyers and emerging investors. Mid-income earners are favouring apartments, which represent more than 88% of the segment, reflecting affordability-focused demand.

Meanwhile, high-income earners (AED 80K+) represent around 18% of the total mortgage cases. These affluent buyers contribute 35% of all investment-related searches, primarily targeting villas (32%) and high-end apartments (63%), highlighting continued wealth-driven confidence in Dubai’s property market.

Overall, the data demonstrates a balanced mortgage landscape, with mid-income residents sustaining transaction volume and market depth, while affluent investors reinforce long-term stability through premium asset purchases.

Cherif Sleiman, Chief Revenue Officer at Property Finder, said, “October’s figures offer fascinating insights into consumer behaviour in the Dubai property market. The slight cooling of the market reflects the annual slowdown over the summer vacation period, but this is not a cause for concern. This moderate drop is offset by overall market resilience, especially in key areas and segments. Key residential areas, such as Nad Al Sheba, Al Barsha and Al Yelayiss 1, continue to be the lifeblood of the property market, along with the Burj Khalifa area, where demand is consistently strong. The shift towards smaller apartments is a significant trend, indicating more people are looking for cost-effective ways to invest in property here, as well as beating rent hikes. While there will likely always be a market for Dubai villas and high-end apartments among high-income earners, more buyers are seeing the practical and financial benefits of apartment living, as demonstrated by this month’s data.”

All the latest information for top listings and communities is available on Data Guru by Property Finder that can be accessed at https://www.propertyfinder.ae/ or on the Property Finder app, available for download on Google Play and Apple Store.