Dubai Property Market Strengthens In 2023, Led By Residential’s Best Year On Record

Dubai’s real estate market has seen steady growth over the past year, driven by the increase in expatriate population, policies such as the recent change to the rules for real estate investors to qualify for the Golden Visa, and Dubai’s growing and diversified economy overall. Savills, a global real estate services provider, released the Dubai Property Market report for 2023, which revealed a robust year across different sectors in Dubai’s real estate market.

Swapnil Pillai, Associate Director of Research at Savills Middle East,said, “The macroeconomic sentiments for the UAE remain favourable. The non-oil sectors have seen significant expansion over the past two years, remain healthy, and are well positioned to grow over the next twelve months,which will benefit the real estate sector. However, there may be a risk of oversupply for select assets across a few locations, which may limit any significant increase in average prices going forward.”

Residential Market

The residential sector had its best year on record. Transaction activity grew by 29% y-o-y to an all-time high of 118,200 units. This was the first time the total transaction volume surpassed the 100K mark. The residential market has witnessed an upward trend since 2021, when 55,500 units were transacted, growing by 69% y-o-y. And within two years, activity levels more than doubled, creating a new milestone for the market. Dubai is now among the few global cities that have sustained growth in demand, which started after the COVID-19-induced restrictions were lifted.

Under-construction properties dominated demand during the year as 55% of the units sold were off-plan. Throughout the year, and more so during the second half, there has been a shift towards investment-led demand while end-user activity has marginally subsided. A total of 65,000 off-plan units were sold in 2023 while 53,200 ready units were sold during the year.

Throughout 2023, market activity continued to shift towards sub-markets in the south east of the emirate. More than 52% of the total units sold in 2023 were concentrated here. Transaction activity was prominent across locations such as Jumeirah Village Circle, DubaiSports City, Arabian Ranches, and Dubai Hills Estate, among others.

Apartments continued to be the most transacted property type, accounting for 78% of the total transactions recorded in 2023. Meanwhile, the demand for villas and townhouses remained stable. Locations like Damac Lagoons, Damac Hills 2, and Arabian Ranches 3 were among the popular locations for villa transactions. Popularly transacted locations had new villa completions in the year, like Joy Townhouses in Arabian Ranches 3, Chorisia Villas in Al Barari, etc., which could be the primary driver for the ready transactions.”

Office Sales and Rental Market

The office real estate market witnessed a surge in demand in 2023. The sustained economic growth, expanding non-oil sector, ongoing push to improve the ease of doing business, and government initiatives to support job creation,such as the Future 100 Initiative, led to a buoyant office occupier demand.

Throughout the year, demand was concentrated across good quality green-certified assets; a gradual yet evident move towards more sustainable operations is driving this trend.

Limited supply of Grade A assets which are most in demand has caused vacancy levels to drop, resulting in a spike in rentals. Buildings in the DIFC micro market and Grade A developments around it were among the most sought-after developments, especially from companies in the financial services and advisory/consultancy sector. This led to an average 22% y-o-y increase in rents across DIFC, however, there were a few developments within the micro-market that have seen yearly rental increases of more than 40%.Across the city,rental values on average have increased by 18% y-o-y for Grade A space.

Paula Walshe, Director of Transactional Services at Savills Middle East,commented, “Unlike other global markets, where demand for office space remains low compared to the pre-pandemic average, in Dubai, the general theme for 2023was one led by expansion and new market entrance. Mergers and acquisitions(M&A) activity across the country also led to consolidation-led demand for office space across the city.”

Co-working operators continued to expand their footprint in the city, owing to strong demand for well-managed spaces that offer flexibility and cost-effective options.

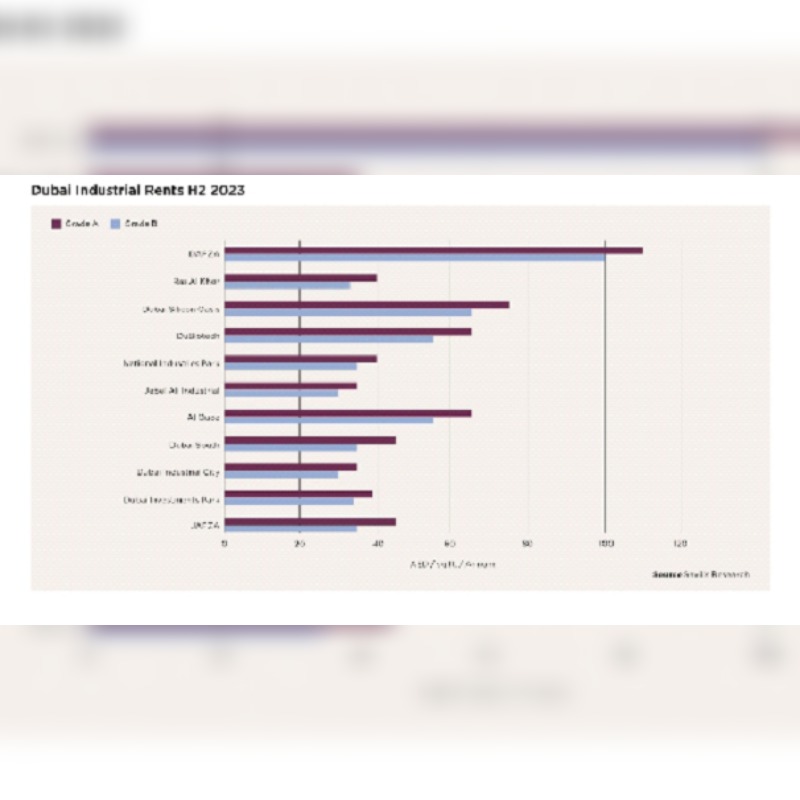

Industrial Rental Market

The industrial and logistics sector in Dubai was among the most resilient real estate asset class in the city. Market activity has remained buoyant throughout 2023, on the back of continued expansion in the non-oil sector. Good quality assets continue to be in short supply, particularly larger facilities over 10,000 sqm, as occupiers expand their warehouse footprint.

Demand for built-to-suit warehousing space was particularly strong from companies as they plan for future expansions and invest in modern warehouse facilities, which offer better operational functionality and sustainability features.

Michael Fenton, Director of Industrial & Logistics at Savills Middle East, added,“Companies from the FMCG, 3PL, retail, and e-commerce sectors were the most active occupiers in 2023. Along with existing occupiers, we saw strong inquiry levels and transactions from new entrants to the market particularly from the Asia Pacific region, which included the manufacturing sector, as opportunities arose to produce and source locally.”

Companies from the oil and gas sector were among the other leading occupiers of warehousing and industrial space across the country. They are gearing up to service the anticipated increase in demand going forward on account of a planned increase in oil production.

Fenton added, “Demand from family offices, investment funds, and high-net-worth individuals to acquire industrial and warehousing assets remained strong. We have also observed interest from regional developers to invest and participate in the sector’s growth.”

At a micro-market level, JAFZA has emerged as the preferred destination for healthcare and pharmaceutical companies as the free zone offers temperature-controlled warehouses and other support infrastructure to support the life sciences sector. Dubai South and Dubai Investment Park (DIP) were among the other active micro-markets for warehousing demand during 2023.

New project launches have also increased, and there is currently close to 650,000 sq. ft. of Grade A space under construction and likely to be handed over by 2024.