IMTIAZ Developments Launches The Symphony, A Dh1 bln Architectural Masterpiece Designed With Zaha Hadid Architects

Dubai-based developer Imtiaz Developments has announced the launch of The Symphony by Imtiaz, a Dh1 billion residential, retail, and office landmark designed in collaboration with globally acclaimed Zaha Hadid Architects (ZHA). It is the company’s most ambitious development within its AED 3 billion (~USD 816 million) Meydan portfolio. Located in Meydan, The Symphony rises over a 4,234 sq. m plot as a sculptural mixed-use development comprising ultra-luxury residences, offices and retail units. The architectural language is drawn from traditional UAE crafts Sadu weaving and Talli embroidery translating their intricate geometries into fluid, contemporary spatial forms. This cultural foundation merges with ZHA’s

AIR Redefines Real Estate: A UAE-Born AI Brokerage

In a significant move towards the UAE’s goal of becoming a worldwide leader in artificial intelligence, AIR (AI Realtor) has announced the launch of the region’s first fully AI-native real estate brokerage platform, built from the ground up in Dubai. Backed by the nation’s National Strategy for Artificial Intelligence 2031, AIR represents the next frontier of technology-driven transformation, powered by the nation’s growing pool of world-class AI and technology talent. Unlike many regional tech models inspired by global counterparts, AIR is not an adaptation but a truly homegrown innovation. It was conceived and built within the UAE’s robust digital ecosystem, one

Over Half Of Dubai Property Deals Cash-Based, Keeping Market Stable Amid Global Monetary Shifts

As central banks in the U.S. and Europe shift from tightening to measured easing, Dubai's real estate market continues to demonstrate resilience, underpinned by strong fundamentals. Disciplined regulation, liquidity strength, and a high share of cash-based transactions have helped the city maintain stability even as international investors adjust to a more selective growth environment. According to analysis by Elite Merit Real Estate, in H2 2025, an estimated 54% of residential property transactions were cash-based, highlighting that liquidity-driven purchases continue to dominate and insulate the market from global interest rate fluctuations. After two years of record-high borrowing costs globally, central banks in

Avenew In Deal To Bring St. Regis Residences To Dubai Islands

Dubai-born Avenew Development is entering the branded residences space following a signed agreement with Marriott International to develop The St. Regis Residences at Dubai Islands. The upcoming project is designed for the modern connoisseur, reflecting the developer’s forward-thinking approach to residential living, where every detail, from interiors to communal experiences, is crafted to inspire connection, elevate lifestyle, and define what it means to truly come home. Avenew Development’s selection of Dubai Islands for this seafront living project highlights its in-depth knowledge and established presence within this transformative area. With other major projects located on the islands, Avenew possesses a proven understanding of

ORA Starts Work On New UAE Coastal Community Project

ORA Developers has broken ground on Bayn, its flagship 4.8-million-sq-m coastal community in Ghantoot region thatblends low-density residential living with resort-style amenities, a vibrant marina, sports facilities, and interconnected waterfront promenades. Announcing the groundbreaking, Ora Developers said enabling works have begun on the 4.8-million-sq-m development strategically located between Dubai and Abu Dhabi with NMDC, a leading EPC contractor in the region, handling it. This marks the construction commencement and enables ORA to progress toward vertical construction for Phase 1 scheduled to begin in the second quarter of 2026. A total of 805 villas and townhouses will be built in the first phase, offering

Meraas Unveils New Chapter Of Nad Al Sheba Gardens

Meraas, part of Dubai Holding Real Estate, has announced the launch of Phase 11 of Nad Al Sheba Gardens, the final cluster of this master community. This phase introduces 210 new villas and townhouses, alongside a state-of-the-art school, further enriching one of Dubai’s most established residential destinations. The new phase represents another milestone in the evolution of Nad Al Sheba Gardens – a master development celebrated for its contemporary design, open green spaces and community-centric lifestyle. Designed to meet the needs of modern families, the latest release will deliver elegant three-bedroom townhouses and four- and five-bedroom villas, all crafted in Meraas’

Cyber Gear To Develop Multiple AI Agents For Dubai Government Entity

Cyber Gear is one of the first local companies to receive the Dubai AI Seal in recognition of its development prowess for AI Agents and AI-Powered industry solutions. This government-issued recognition positions Cyber Gear among a select group of trusted AI providers actively shaping the future of Dubai’s digital economy. According to Sharad Agarwal, CEO of Cyber Gear, “What used to take 3 months with a team working on a given job will now take 60 minutes.AI agents are no longer experimental tools. They are becoming core productivity engines across industries. Their ROI is proving significantly higher than traditional automation because

London Gate And Franck Muller Celebrate Hat-Trick Success With Yachting Sell-Out

In a market where luxury has many definitions, London Gate and Franck Muller have found their winning formula and buyers can't get enough. The complete sell-out of Franck Muller Yachting, their third collaboration valued at AED 900 million, proves that when Swiss precision meets Dubai ambition, something special happens. This isn't just another tower joining Dubai's skyline. Rising in Dubai Maritime City, Yachting captures something intangible — that feeling of freedom you get standing on a yacht deck at sunset and translates it into a home you return to every day. “Three projects, three sell-outs – it's humbling, honestly, says Eman Taha,

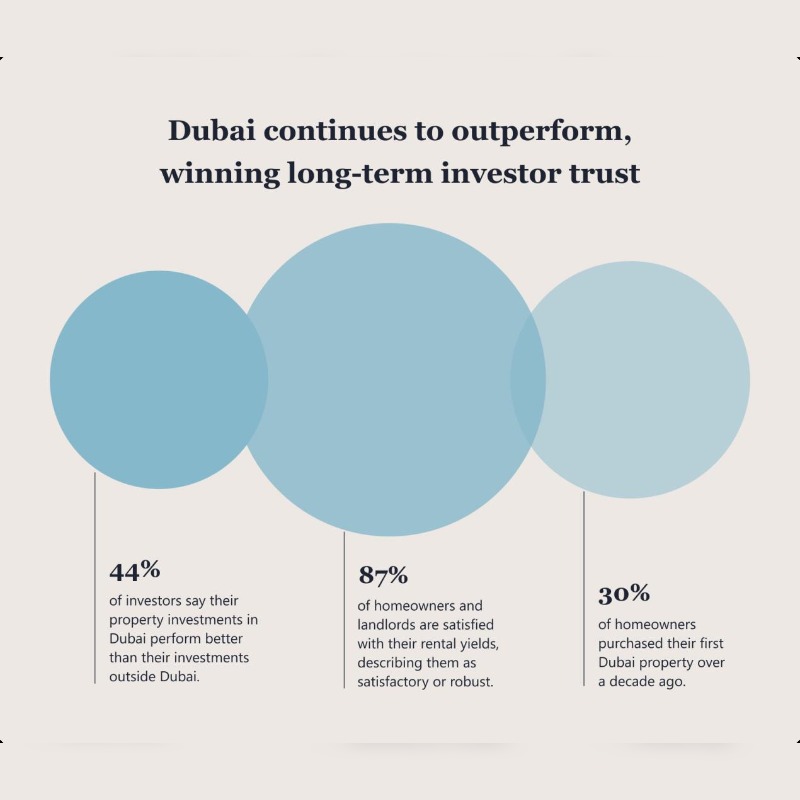

44% Of Property Investors Say Their Dubai Investments Outperform Their Overseas Portfolios, According To Betterhomes’ Future Living Report 2025

New findings highlight a structural shift as Dubai cements its status as one of the world's most stable and high-performing real estate markets. Futureliving Report 2025 is the only industry-wide study that looks beyond transactions. Now in its second edition, the report analyses the behaviour, sentiment, and long-term outlook of residents and property owners across Dubai. One of the report's most defining findings shows that 44% of homeowners say their Dubai property investments deliver stronger returns than their investments overseas, reaffirming the emirate's global competitiveness. The insight reflects a maturing market in which both capital appreciation and rental yields continue to outperform major global

Meraas Launches Crestlane 4 And 5, Advancing Contemporary Urban Living At City Walk

Meraas, part of Dubai Holding Real Estate, has announced the launch of Crestlane 4 and Crestlane 5, introducing 360 new premium residences to City Walk and further advancing the district’s evolution as one of Dubai’s most contemporary urban neighbourhoods. The new phases follow the strong market response to earlier releases and expand Crestlane’s distinctive expression of modern, design-led living. Each phase comprises two mid-rise towers set around landscaped green spaces, flowing water features and open views towards the Dubai skyline. Crestlane 4 will include 201 residences, while Crestlane 5 will offer 159 homes, featuring a curated selection of one- to four-bedroom