Property Finder Data Shows Abu Dhabi And Dubai Real Estate Hit Record Highs In Q3 2025 – Breaking All Records

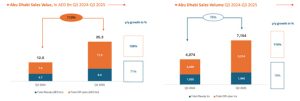

Property Finder, the MENA region’s leading property platform, has unveiled record Q3 results for the robust property markets in both Abu Dhabi and Dubai. Abu Dhabi’s real estate market reached a historic peak in Q3 2025, driven by strong investor confidence and structural market changes. Total sales transactions soared to 7,154 – a 76% year-on-year increase – while the total value surged by 110% to AED 25.3 billion. Meanwhile, in Dubai, 59,044 sales transactions were executed, representing a 17% year-on-year increase, with the total value up by 19% to AED 169 billion.

Thoughtful Development in Abu Dhabi is Reaping Rewards

The historic peak in Abu Dhabi’s real estate market, with a 76% year-on-year increase in sales transactions, has been attributed to a number of key factors.

- A structural upturn in demand has been supported by improved liquidity.

- The strategic shift towards master-planned communities and sustainable development is boosting the market in line with the emirate’s 2030 urban diversification agenda.

- The residential sector has been the main catalyst for growth, accounting for 96% of volume – 6,883 transactions have a total value of AED 23.3 billion, a 107% year-on-year increase.

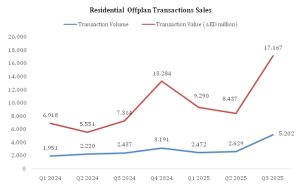

Abu Dhabi’s Off-plan Market Continues to Thrive

The record Q3 performance was overwhelmingly dominated by off-plan transactions, which comprised 73% of all sales and 68% of the total value. Abu Dhabi’s off-plan value spiked by 136% year-on-year, reaching AED 17.3 billion. Residential sales made up 99% of this value.

High value transactions in new properties on Fahid Island (Aldar) and Al Hidayriyyat Island (Modon), fuelled the off-plan sector momentum. The Q3 off-plan sales at these two projects accounted for 30% of the total residential off-plan value.

Investor appetite for diverse formats continues, with sales surging in specific residential sectors.

- Off-plan Apartments dominated, with transaction values increasing by 276% and volumes by 198%, highlighting a shift towards early-stage investment in vertical communities.

- Off-plan Villas saw solid expansion, with values up 68% and transactions rising 42%.

- Off-plan Duplexes performed exceptionally well, registering a 424% jump in value and a 255% increase in activity, showcasing traction for mid-luxury hybrid layouts.

Ready Market on the Rise in Abu Dhabi

The ready market showed strong gains, recording AED 8 billion in value, representing a substantial 71% year-on-year rise, across 1,940 transactions. This affirms sustained end-user absorption despite factors such as higher mortgage rates. Residential ready sales grew by 15% in volume and 56% in value, totaling AED 6.1 billion, with dual-track demand from mid-tier buyers and luxury villa investors.

- Al Reem Island and Al Raha Beach led the activity, driven by dense, move-in-ready apartment stock.

- Al Reef continued to attract mid-ticket, family buyers.

- Saadiyat Island contributed high-ticket villa transactions, significantly lifting the average ticket size.

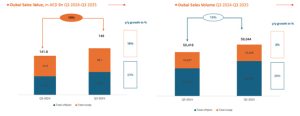

Dubai Remains a Safe Destination for International Property Investment

Dubai’s real estate market reached an unprecedented peak in Q3 2025, recording its highest-ever quarterly transaction volume. A total of 59,044 sales transactions were executed – a 17% year-on-year increase – with the total value surging by 19% to AED 169 billion. These results surpass all previous market highs, reinforcing Dubai’s status as a global capital magnet and safe investment hub, benefiting from sustained international capital inflows and population growth.

Off-Plan Drives Forward-Looking Investment

Like neighbouring Abu Dhabi, Dubai’s record Q3 performance was primarily fuelled by the off-plan sector, which is driving forward-looking investment behaviour. Off-plan activity soared to 40,108 transactions, representing a 26% increase year-on-year, and making up 68% of the total market volume. The value reached its highest-ever quarterly total at AED 82.9 billion, reflecting a 23% year-on-year rise.

Key districts with master-planned developments remain crucial to Dubai’s long-term confidence.

- Business Bay alone accounted for around AED 7.4 billion in sales, boosted by new launches.

- Projects in Al Barsha and Dubai Islands demonstrate that buyers are prioritising investment in high-potential master-planned communities.

Value-driven Demand Wins Out Over Volume

Again mirroring trends in Abu Dhabi, Dubai’s ready sales market continued to grow, albeit more modestly than the capital. Dubai registered 18,936 transactions in Q3 2025, contributing 32% of the total volume, a 2% year-on-year increase. Crucially, the segment’s value saw a remarkable 16% increase to AED 86.1 billion, indicating demand is increasingly value-driven rather than volume-driven.

Value-driven strength is concentrated in established premium districts, reflecting a mature market phase focused on capital preservation and luxury end-user migration.

- Wadi Al Safa 3 recorded more than AED 7 billion in transactions, driven by demand for land

- Business Bay was another solid ready sales performer, supported by ultra-luxury resales, emphasising its enduring appeal to high-net-worth buyers.

- Palm Jumeirah and Marsa Dubai (Dubai Marina) together generated more than AED 6 billion, underscoring sustained global investor interest in apartment-driven, waterfront living.

Cherif Sleiman, Chief Revenue Officer, Property Finder commented, “The record-breaking performance we’re seeing in both Dubai and Abu Dhabi underlines the UAE’s position as one of the world’s most resilient and attractive property markets. Abu Dhabi is setting new benchmarks with sustainable, master-planned communities that are clearly resonating with buyers, while Dubai’s shift towards value-driven demand shows a maturing market where investors are focused on long-term stability and wealth preservation. Together, these trends highlight the UAE’s strength as a global safe haven for real estate investment.”