DHG Properties Launches Helvetia Verde, The New High-Rise In Meydan Horizon

DHG Properties, a Dubai-based developer and part of the Swiss real estate and construction group DHG, has launched Helvetia Verde, a premium residential tower set in the prestigious upcoming district of Meydan Horizon, previously known as Bukadra. The project is the latest under the Helvetia brand – DHG’s real estate signature inspired by the Latin name for Switzerland, created to reflect Swiss craftsmanship, unmatched quality and exceptional living. Helvetia Verde carries the legacy of DHG Properties’ debut development in the UAE – Helvetia Residences in JVC – embodying sophisticated elegance, superior comfort, and sustained value in each of the 108 apartments

Flora Shore Beachside Residences Launch Marks A Major Milestone On Dubai Islands

Flora Shore Beachside Residences, a 14-storey residential development nestled in the heart of the Dubai Islands, has officially launched. The project will offer an elite lifestyle with a blend of architectural elegance, premium amenities, and panoramic sea views. The signing ceremony took place at the OCTA Sales Centre, marking a major milestone for the project's developer, Calgary Properties, in partnership with Flora Realty and exclusive sales and marketing partner OCTA Properties. Set for handover in Q3 2027, Flora Shore introduces a curated collection of 2, 3, and 4-bedroom residences inspired by coastal living. The tower is strategically positioned just minutes from Dubai Islands'

Introducing Dubai’s First Corinthia Residences

Driven | Forbes Global Properties has been appointed as the exclusive sales partner for the residences at Corinthia Dubai, including both branded and non-branded residences. Developed by Dubai General Properties, the twin towers on Sheikh Zayed Road will also feature Dubai's first Corinthia five-star, ultra-luxury hotel. “This project stands out for its clarity of vision: an iconic address that pairs a five-star hospitality experience with a versatile residential offering. It’s the kind of development that creates long-term value for residents and investors alike,” said Abdullah Alajaji, Founder and CEO of Driven | Forbes Global Properties. “Our team is honored to be

SAMANA Redefines Arjan Living With ‘Flexible Homes’ And Private Pools At Imperial Garden

Samana Developers, an award-winning leader in Dubai real estate, just unveiled its newest residential project, SAMANA Imperial Garden, set to add resort-style luxury into the burgeoning Arjan district with the introduction of Flexible Homes. SAMANA Imperial Garden: A Premium Investment in Arjan The SAMANA Imperial Garden project is a substantial AED 398 million investment by Samana Developers, set to deliver 344 premium residential units with an estimated handover in March 2029. This development pioneers the Flexible Homes concept, using integrated smart furniture to maximize space and adaptability. This innovation allows units to be seamlessly reconfigured, meaning a studio can convert to a

Dubai Real Estate: Q3 2025 Residential Transactions Reach AED 138 Billion As Demand Remains Resilient Across Off-Plan And Ready Markets

Dubai’s residential real estate market continued to show remarkable resilience and growth in the third quarter of 2025, according to the latest report from Espace Real Estate (Dubai Residential Market Overview - Q3 2025). Transaction volumes remained robust, supported by sustained demand across both off-plan and ready properties. The new report reinforces the Emirate’s growth trajectory, as Dubai’s residential market continues to demonstrate strength and liquidity with sustained demand across all segments. The quarter recorded 55,280 residential transactions valued at AED 138 billion, representing an 18 per cent year-on-year increase from the same period in 2024. The performance underscores the market’s

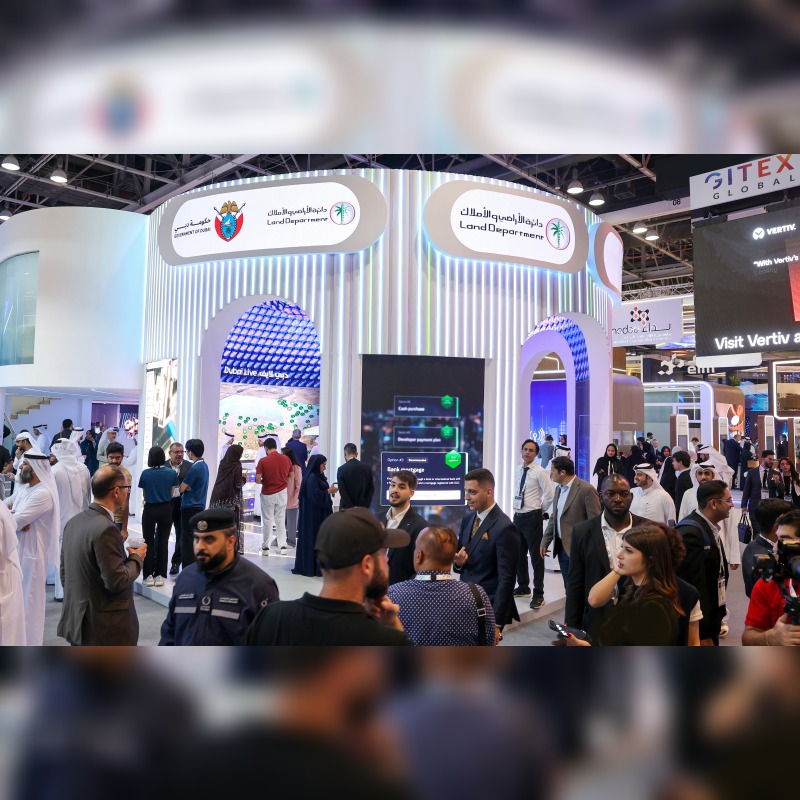

Dubai Land Department At GITEX Global 2025: 19 Years Of Digital Transformation Shaping The Smart Real Estate Future

Building on over 19 years of pioneering digital innovation and government excellence, Dubai Land Department (DLD) is participating in GITEX Global 2025, the world’s largest technology event. The participation reaffirms DLD’s leading role in driving the smart transformation of the real estate sector, enabling investment, regulating the market, and safeguarding the rights of investors and customers. Through this participation, DLD showcases a new generation of digital solutions and global partnerships that enhance service efficiency, market transparency, and Dubai’s position as a global hub and the premier destination for sustainable real estate investment. Since its early journey toward digital transformation and through

Dubai Land Department Unveils ‘Digital Sale’ Service On Dubai Now App At GITEX Global 2025

The Dubai Land Department (DLD) launched the first phase of the ‘Digital Sale’ service through the Dubai Now appas part of its participation in GITEX Global 2025. Reaffirming Dubai’s leadership in driving digital transformation, this milestone underscores the emirate’s commitment to advancing the objectives of the Dubai Economic Agenda D33 and the Dubai Real Estate Strategy 2033. The initiative sets new benchmarks for the speed, reliability, and efficiency of real estate transactions, supporting Dubai’s vision of a sustainable, knowledge-based digital economy. The service represents a major leap in the way real estate transactions are conducted, enabling customers to complete registration and sale

Amirah Developments Announces Construction Progress At Bonds Avenue Residences, Dubai Islands

Amirah Developments, a premium Dubai-based real estate developer, has announced the commencement of piling and shoring works for its flagship project Bonds Avenue Residences located in the heart of Dubai Islands, one of the emirate’s most visionary coastal destinations. Following its official ground-breaking ceremony in June 2025, the project has rapidly transitioned into the active construction phase, reflecting Amirah Developments’ steadfast commitment to timely delivery, superior quality, and sustainable urban development. The smooth handover from the design to construction teams has ensured an accelerated site mobilisation, with piling rigs and shoring machinery already operating on schedule. The development remains on track

Tarrad Development Launched 3 New Residential Projects In Dubai

Tarrad Development announced the launch of three new residential projects in Dubai as part of its distinguished series of projects. The official announcement was made during a special event organized by the company on Saturday, October 11, 2025, in Dubai. The event was attended by prominent dignitaries, senior local and international investors, representatives of real estate companies, banks, real estate brokers, and professionals from across the UAE’s property sector. The company noted that the first project, Celesto 1, located in Dubailand, has achieved 100% sales following strong demand since its initial launch. Construction and development works are progressing according to the approved

Property Finder Data Shows Abu Dhabi And Dubai Real Estate Hit Record Highs In Q3 2025 – Breaking All Records

Property Finder, the MENA region’s leading property platform, has unveiled record Q3 results for the robust property markets in both Abu Dhabi and Dubai. Abu Dhabi’s real estate market reached a historic peak in Q3 2025, driven by strong investor confidence and structural market changes. Total sales transactions soared to 7,154 – a 76% year-on-year increase – while the total value surged by 110% to AED 25.3 billion. Meanwhile, in Dubai, 59,044 sales transactions were executed, representing a 17% year-on-year increase, with the total value up by 19% to AED 169 billion. Thoughtful Development in Abu Dhabi is Reaping Rewards The