Danube Properties Launches Exclusive 0.5% Monthly Payment Plan As A Special Ramadan Offer

In celebration of the holy month of Ramadan, Danube Properties has unveiled an exclusive 0.5% per month payment plan, reaffirming its commitment to making homeownership in Dubai more accessible while embracing the spirit of community and generosity that defines this auspicious season. Designed to empower aspiring homeowners and investors, the limited-time Ramadan offer reflects the company’s customer-first philosophy. The 0.5% monthly payment plan enables buyers to invest in premium properties with enhanced flexibility and ease. This exclusive offer is valid until March 31, 2026. The initiative also embodies the vision of Mr. Rizwan Sajan, Founder and Chairman of Danube Group, who has

Dugasta Properties Ties Up With JioStar’s New Reality Show The 50

Dugasta Properties has come onboard as the Presenting Sponsor for JioStar’s newest reality show The 50, currently airing on Colors TV across India and the Middle East. The 50 is one of television’s newest large-scale entertainment formats, designed for high engagement and strong cross-market visibility. A JioStar spokesperson said, “Partnering with Dugasta Properties reinforces our focus on building strategic brand alliances around scalable entertainment formats. We are delighted with the positive response on the show and are thrilled to present a meaningful platform for brands to engage with audiences across markets. This partnership reflects the increasing demand for integrated, cross-market brand visibility.” Mr. Tauseef Khan, Founder and Chairman,

Zoya Developments Unveils Miorah By Zoya, Valued At AED 37.5mln, Premium Fully-Furnished Residences In Dubai South

Zoya Developments, a leading name in shaping modern communities across the UAE, has launched Miorah by Zoya, valued at AED 37.5 million. A premium collection of 60 fully furnished apartment residences, the project is located in the thriving hub of Dubai South. With meticulously curated interiors, hand-selected finishes, and a suite of lifestyle and wellness-focused amenities, Miorah promises residents a harmonious blend of comfort, convenience, and contemporary living. Scheduled for handover in Q2 2027, Miorah offers 28 studios (400–427 sq. ft., from AED 640,000) and 32 two-bedroom apartments (817–1,018 sq. ft., from AED 1.1 million), all featuring spacious open-plan layouts and

Aldar Introduces The Wilds Residences, Deepening The Nature-Led Vision Of The Wilds Community In Dubai

Aldar today announced the launch of The Wilds Residences, comprising six mid-rise apartment buildings nestled within The Wilds, the company’s landmark nature-driven community in Dubai. The launch builds on the successful sellout of villas in the first phase, which generated AED 5 billion in sales, underscoring strong demand for wellness-led living communities. Part of Aldar’s joint venture with Dubai Holding, The Wilds Residences blends thoughtfully designed homes with serene landscapes, adding further depth to The Wilds masterplan, which will immerse families and young adventurers in nature and abundant wildlife. The new development comprises 740 one- to three-bedroom apartments and two- to three-bedroom

Timely Delivery The Key For Developers In Face Of Rising Dubai Construction Costs

With rising construction costs reshaping the economics of Dubai’s real estate market, a project in Business Bay has shown that timely delivery remains the most powerful assetfor developers. Century Tower, a 23-floor residential building comprising 210 units, has completed handovers two months ahead of schedule, a rarity in today’s property sector. Developed by AMBS Real Estate Development, with sales led by fäm Properties as master agent, the project is a reminder that finishing projects on or ahead of schedule can make all the difference in an increasingly competitive real estate landscape. Firas Al Msaddi, CEO of fäm Properties, says the message to developers

Samana Developers Joins Dubai Land Department’s First Home Buyer Programme To Empower Homeownership

Samana Developers, an award-winning real estate developer based in Dubai, is pleased to announce its official accession to the First-Time Home Buyer (FTHB) Programme, a landmark government initiative launched by the Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism (DET). This strategic partnership underscores Samana Developers' commitment to making luxury resort-style living accessible to the Emirate’s growing population of long-term residents. By joining the programme, Samana Developers aligns its massive 2025 expansion with the national agenda, offering first-time buyers priority access to up to 10% inventory, 2% discount, extended payment flexibility, and waived administrative fees across its diverse

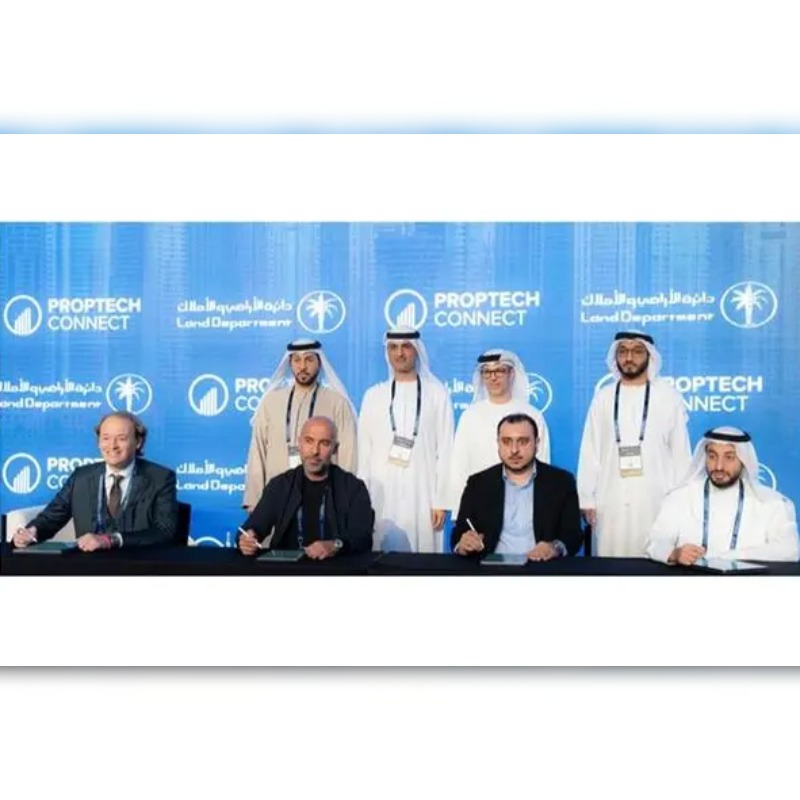

Seven Companies Join REACH Middle East Aiming To Build Dubai’s Next Real Estate Unicorn

Dubai has produced global aviation giants, fintech disruptors and e-commerce powerhouses. Now, it is setting its sights on creating the next billion-dollar real estate technology company. REACH Middle East has cherry-picked seven innovative start-ups with a real chance of becoming a homegrown unicorn. The finalists have each received financial backing and were narrowed down from nearly 100 entries. Endorsed by the Dubai Land Department, Dubai Technology Entrepreneurship Campus (Dtec) and backed by global venture platform Second Century Ventures, the eight-month accelerator will nurture a technology cohort and scale opportunities for company founders solving real-world challenges. The chosen businesses are striving to make

Union Properties Enters A New Era With Record Performance And Proposed Dividend Revival

Union Properties PJSC (“Union Properties” or “the Company”) (DFM: UPP) announced its audited financial results for the fiscal year 2025, marking one of the Company’s strongest performances in recent years and a historic milestone with the Board of Directors proposing a cash dividend of AED 3 Fils per share, the first cash dividend in 11 years. The Company recorded total revenue of AED 736.9 million, representing a 39.4% increase compared to AED 528.7 million in 2024. The proposed reinstatement of dividends reflects the successful culmination of the Company’s multi-year recovery plan, the restoration of long-term financial strength, and a renewed commitment

Rentify Launches UAE’s First AI-Native Rent Infrastructure With Rentify Pay

Rentify, a leading fintech and proptech innovator, today announced the launch of Rentify Pay, UAE's first rent-native infrastructure layer. This launch marks a significant evolution from Rentify's original "Rent Now, Pay Later" service, introducing a comprehensive platform that digitizes and streamlines the entire rental ecosystem for tenants, landlords, and property managers. In UAE, where majority of residents are long-term renters and expatriates, rent represents the largest recurring financial commitment for most households. Since its founding, Rentify has offered over 10,000 rental units flexible payment solutions that benefit both tenants (who save money and earn rewards) and landlords (who receive upfront payments

Eightclouds Real Estate Investment Fund Launch

EIGHTClouds is pleased to announce the launch of its EIGHTClouds Real Estate Investment Fund (‘The Fund’), an open-ended investment vehicle engineered to deliver predictable income and long-term capital appreciation through a diversified portfolio of high-yield income-generating residential assets across Dubai and the wider United Arab Emirates. The Fund targets US$300 million+ in committed capital and US$600 million+ in gross asset value over its first decade, anchored by disciplined acquisitions in high yield communities with proven liquidity and sustained tenant demand. Investors receive quarterly dividends of 100% of free cash flow, alongside exposure to long-term capital gains. Mark Aitchison, Founder and Chief Executive