Binghatti Holding H1’25 Financial Results

Binghatti Holding Ltd, a leading UAE luxury real estate developer, reported record financial results for the first half of 2025, with year-on-year profit and revenue almost tripling, driven by the continued demand for Binghatti developments.

Net profit in the first half of 2025 rose 172% year-on-year to AED 1.82 billion, compared to AED 668 million in the same period last year. Total sales reached AED 8.8 billion, representing a 60% year-on-year increase, while revenue surged almost threefold to AED 6.3 billion, making the Company one of the fastest growing in Dubai’s real estate market.

The Group also saw strong expansion of its development pipeline. As of 30 June 2025, Binghatti’s revenue backlog reached AED 12.5 billion, compared to AED 6.6 billion in the same period last year. The surge in backlog was driven by the launch of seven new projects, while five projects were successfully delivered during the first half, handing over 1,441 units into the market.

Branded Residence Drive Global Investor Demand

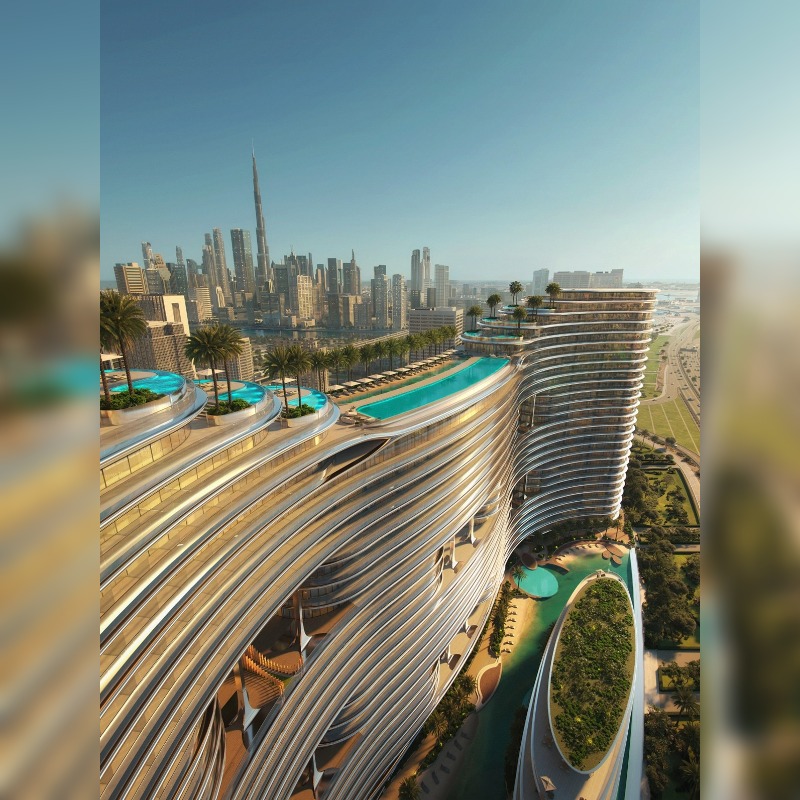

Binghatti’s flagship branded residences, developed in collaboration with world-renowned luxury partners Bugatti, Mercedes-Benz, and Jacob & Co. continue to resonate with global customers. The Company’s ability to blend architectural innovation with iconic design has attracted an elite international clientele, including Brazilian football star Neymar Jr. and acclaimed opera singer Andrea Bocelli, reflecting Binghatti’s status as the preferred ultra-luxury brand for investors around the round the world.

In H1 2025, 61% of Binghatti’s sales were made to non-resident buyers, up from 55% a year earlier, underscoring Dubai’s safe-haven appeal and BinGhatti’s pro-active marketing, which include the launch of a London sales office in July. Leading buyer nationalities in H1 2025 included India, Turkey and China.

Supporting Strong Local Demand Through Strategic Financing Solutions, PropTech

While international investors continue to play a growing role in driving sales, Binghatti also continued to benefit from strong local demand, supported by the UAE’s expanding population, and ongoing investment in infrastructure and housing accessibility. The Company continued to broaden its domestic customer base by improving affordability and access to high-quality real estate developments.

In May 2025, Binghatti signed a landmark Memorandum of Understanding with Abu Dhabi Islamic Bank (ADIB) to offer Sharia-compliant home financing solutions tailored to both ready and off-plan residential units. Under the agreement, eligible buyers will be able to secure financing once construction reaches 35% completion and 50% of payments have been made, a flexible structure designed to unlock new demand among UAE-based homeowners and investors.

To further support access to homeownership, Binghatti Holding was selected in July by the Dubai Land Department (DLD) and the Dubai Department of Economy and Tourism (DET) as one of 13 developers participating in the newly launched First-Time Home Buyer (FTHB) Programme. As part of this initiative, Binghatti has committed to allocating at least 10% of its newly launched and existing residential units priced under AED 5 million exclusively to eligible first-time buyers. The earmarked units will be made available ahead of public launches, ensuring early access and greater affordability for UAE residents entering the property market for the first time.

In addition to prioritised access, Binghatti is offering exclusive financial incentives to FTHB participants, including discounts on selected properties and reduced administrative fees, with enhanced packages for both Emiratis and expatriates. The initiative supports Dubai’s broader economic and social development goals, including the D33 Economic Agenda which targets AED 1 trillion in real estate transactions

In July, Binghatti also became a founding partner of the Dubai PropTech Hub, a joint initiative of the DIFC Innovation Hub and the Dubai Land Department. The Hub, which aims to attract $300 million in venture capital by 2030, will position Binghatti at the forefront of real estate innovation through access to emerging technologies such as AI, blockchain, and sustainable smart infrastructure. As a founding partner, Binghatti will benefit from early engagement with next-generation PropTech start-ups through the Hub’s Living Lab, Scale-up Accelerator, and bespoke innovation programs.

Accelerated Development and Landmark Land Acquisition

Binghatti currently has around 20,000 units under development across about 30 projects in prime residential areas across Dubai, including Downtown, Business Bay, Jumeirah Village Circle, Al Jaddaf, Meydan, Dubai Science Park, Dubai Production City, and Sports City.

During the first half, Binghatti launched seven new projects featuring 5,000 units spread over 3.8 million square feet and and handed over five developments comprising 1,441 units over 1 million square feet. The company acquired a landmark megaplot in Nad Al Sheba 1, in the heart of Dubai’s sought-after Meydan district with over 9 million square feet of gross floor area, which will serve as the foundation for its first master-planned residential community in Dubai with a total development value of over AED 25 billion.

Strengthened Credit Profile Recognised by Global Rating Agencies

In the first half of 2025, Binghatti’s credit profile was formally recognised by leading global rating agencies. In March, Moody’s Ratings assigned Binghatti a first-time Ba3 Corporate Family Rating (CFR) with a stable outlook, citing the Company’s strong market position in Dubai’s luxury real estate sector, its vertically integrated operating model, and prudent financial management. The agency highlighted Binghatti’s low leverage, strong liquidity, and effective cost control as key credit strengths, alongside its strategic expansion through branded developments and a deep pipeline of projects.

Shortly after, Fitch Ratings upgraded Binghatti’s Long-Term Issuer Default Rating (IDR) and senior unsecured debt to BB- from B+, also with a stable outlook. The upgrade reflected Binghatti’s resilient growth trajectory, robust liquidity – including a low net debt-to-EBITDA ratio of just 0.8x – and its ability to self-fund future projects through internally generated cash flows. Both agencies recognised the Company’s strengthened corporate governance framework and the institutional credibility brought by its inaugural USD 500 million sukuk, which is listed on both the London Stock Exchange and Nasdaq Dubai.

Positive Outlook Amid Structural Supply Constraints

Dubai’s real estate market continues to show structural strength, supported by a growing population, stable governance, and surging global investor interest. As of June 2025, Dubai’s population surpassed 3.75 million and is expected to exceed 4 million by the end of 2026. In the first half of 2025 alone, over 19,700 new residential units were handed over, primarily in JVC, Al Merkadh and Business Bay. However, delivery across core and premium submarkets has not kept pace with demand.

This gap is even more evident in the luxury and branded segment, where sustained demand continues to drive strong absorption rates. Rental values in prime zones such as Marina, Business Bay, and Downtown Dubai are up significantly year-on-year, clear indicators of supply pressure and investor appetite.