Bayut’s Q1 2024 Data Shows Stable Apartment Prices Amidst Continued Property Surge

Wrapping up the first quarter of 2024, Bayut, the leading property portal in the UAE, has released insights into the most searched areas within the emirate’s real estate sector. Through its latest property market analysis, Bayut has offered a valuable collection of data to property seekers, aiding them in improving their decision-making processes with comprehensive market intelligence.

In accordance with the search trends analysed on Bayut, the previous upward trend in property prices across Dubai has stabilised considerably, with certain areas even reporting declines in average prices. While the market has continued to enjoy sustained interest from investors and end-users, there is also a healthy influx of new properties, ensuring adequate supply to meet the demand for housing within the emirate.

Trends for Buying Properties in Dubai

- According to Bayut’s data, there has been a modest increase in sales prices for apartments and villas in prominent neighbourhoods of Dubai, with the highest surges reaching up to 7% during the first quarter of 2024.

- For affordable properties, there has been increased interest from potential investors and homebuyers in areas such as International City, Dubai South, DAMAC Hills 2, and Dubailand. Individuals with a mid-range budget have shown a preference for neighbourhoods like Jumeirah Village Circle, Jumeirah Lake Towers, Al Furjan, and The Springs. In contrast, investors seeking luxury properties have searched for units in popular areas including Dubai Marina, Business Bay, Arabian Ranches, and Dubai Hills Estate during Q1 2024.

- In the affordable segment, transactional sales prices for apartments in highly searched areas have decreased from 1% to 16%, with the exception of Dubai South, which registered a moderate increase of 4.48%. On the other hand, the average transaction prices for affordable villas have predominantly seen upticks ranging from 7% to 62%, with Dubailand reporting the most significant increase in transactional price.

- When it comes to mid-tier properties, there has been a significant rise in the average sales transaction prices for apartments, ranging from 6% to 42%, with the most noticeable uptick recorded in Jumeirah Lake Towers. Similarly, sought-after areas featuring mid-tier villas have observed increases in average transaction sales prices ranging from 5% to 14%. Notably, Al Furjan stands out as an exception, experiencing a slight decrease of 0.37% in its transactional sale price.

- In the luxury property segment, the majority of areas have witnessed a steady appreciation in transactional prices ranging from 2% to 23%.

- As per Dubai Transactions on Bayut, the company’s proprietary data and insights solution with meticulously processed data based on DLD information, Q1 2024 witnessed a cumulative total of 36,946 property sale transactions. These transactions amounted to a total value of AED 109.6 billion, encompassing both residential and commercial acquisitions.

- When it comes to Return on Investment (ROI) based on projected rental yields for apartments, certain areas such as DIP, Discovery Gardens, and Liwan have surfaced as the most viable options for potential investors, boasting yields of up to 11%. In the mid-tier apartment segment, Dubai Sports City, Dubai Silicon Oasis, and Motor City have emerged as highly appealing choices, offering rental yields of up to 10%. Additionally, in the luxury apartment sector, locales like Green Community, Al Sufouh, and DAMAC Hills have demonstrated exceptional attractiveness, yielding returns exceeding 8%, thereby surpassing benchmarks established by the majority of global markets.

- Bayut’s analysis of Return on Investment (ROI) trends for villa communities also reflects a promising outlook. Buy-to-let villas and townhouses in International City exhibit an average ROI exceeding 7%, rendering it an appealing option for potential investors. Similarly, areas such as DAMAC Hills 2 and The Valley offer ROI percentages surpassing 6%. Mid-tier villas in Jumeirah Village Triangle, JVC and Mudon have projected ROIs ranging between 6% and 8%. In the luxury villa segment, The Sustainable City stands out with an ROI exceeding 7%, attributed to the distinctive features of the properties and the limited market supply it offers. Additionally, communities like Al Barari and Tilal Al Ghaf, catering to family needs, present robust ROIs exceeding 6%.

Trends for Renting Properties in Dubai

- As per Bayut’s data analysis, advertised rental prices have exhibited surges across various segments in sought-after areas. Affordably priced apartment rentals have experienced increases ranging from 1% to 17%, while mid-tier segment apartments have seen upticks of up to 12%. Conversely, luxury apartment rentals have witnessed decreases of up to 4%.

- Reasonably-priced villas have generally become cheaper by up to 3%, with rental houses in Mirdif recording upticks of 1% to 7%. Mid-tier villa rentals have recorded increases in the range of 2% to 17%, with certain bed types in JVC and Town Square reporting price decreases of under 2%. Luxury villa rentals have surged by 13%, although 4-bed homes in Al Barsha and DAMAC Hills have become relatively more affordable by 12% to 14%.

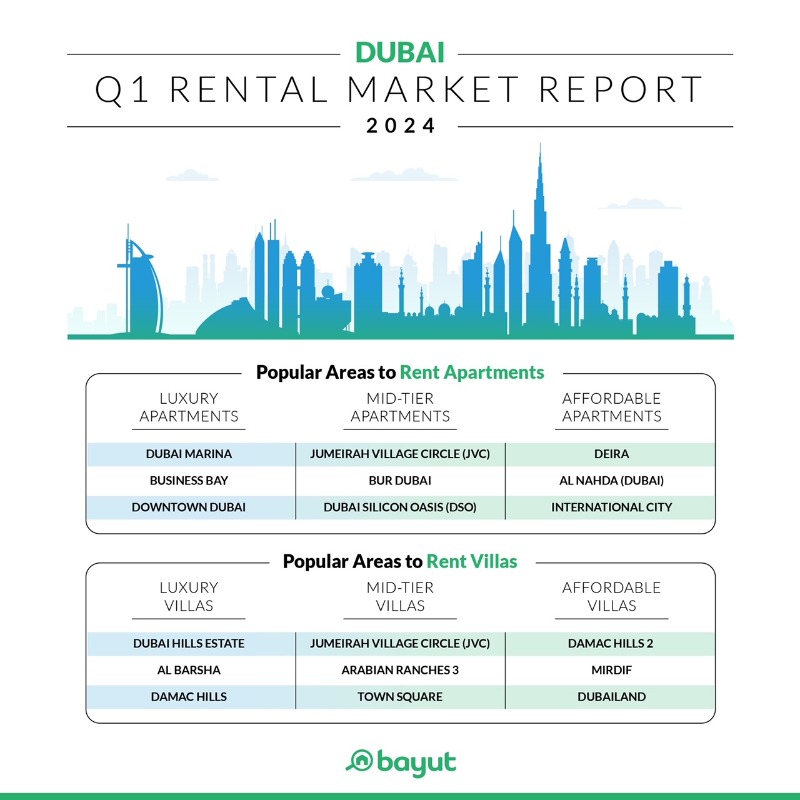

- Among those seeking affordable accommodations, Deira and Al Nahda have emerged as popular choices for apartments, while DAMAC Hills 2 and Mirdif have garnered attention for villas. In the mid-tier segment, Jumeirah Village Circle (JVC) and Bur Dubai apartments have been in high demand among tenants, whereas properties in JVC and Arabian Ranches 3 have attracted villa-seekers. In the luxury category, Dubai Marina and Business Bay have remained sought-after destinations for apartment rentals, while Dubai Hills Estate and Al Barsha have been favoured for high-end villa rentals.

- Analysing transactional rental prices, increases in affordable neighbourhoods for both villas and apartments have typically ranged between 1% and 5%. Meanwhile, mid-tier segment apartment and villa rentals have reported increases of up to 12%. In the luxury segment, transactional prices for both apartment and villa rentals have risen by 5%. However, luxury villa rentals in DAMAC Hills have witnessed a decrease of 7.24%.

There is a noticeable resurgence in the demand for family villas. The market has witnessed a heightened interest in larger family-oriented residences, particularly within luxury and mid-tier communities, indicating a shift towards more spacious properties and a preference for family-friendly living environments.

Commenting on the findings, Haider Ali Khan, CEO of Bayut and Head of Dubizzle Group MENA, said:“Dubai’s real estate market remains promising despite ongoing global uncertainties, with prevailing market trends, investment opportunities and growth strategies instilling confidence in stakeholders navigating its dynamic landscape. The emergence of new master communities and innovative approaches to off-plan developments underscore Dubai’s resilience and appeal as a real estate hub. As we confront the challenges and opportunities ahead, fostering collaboration and strategic planning will be pivotal in maximising returns and creating sustainable growth in Dubai’s real estate sector. We take our responsibility in this regard very seriously and have been supporting the DLD with expedited tech solutions to create a more transparent and fair environment where we reward agents and agencies who advertise quality content and eliminate inaccurate listings even before they are posted.

As always, Bayut is committed to contributing to the promising prospects of the real estate industry. In line with our on-going partnerships with the Dubai Land Department (DLD), we have also partnered on a new initiative to facilitate the integration of Emirati talent into Dubai’s expanding real estate sector. We eagerly anticipate the development of this partnership in nurturing and training fresh talent, which could significantly contribute to the sector’s future growth.”